A billion-dollar stoush has begun between the board of hotel and liquor retailing giant Endeavour and its largest shareholder, Bruce Mathieson, based in the mismanagement of the company.

Endeavour holds a portfolio of over 350 pubs and clubs through its pubs division ALH, with the biggest collection of EGMs in the country, plus six wineries and 1,700 bottleshops, predominantly branded Dan Murphy’s and BWS. The company is headed by CEO Steve Donohue and the board chaired by Pizza Hut executive Peter Hearl.

Billionaire Bruce Mathieson controls 15 per cent of the listed entity. The next largest shareholder is Woolworths, with nine per cent, followed by AustralianSuper, Vanguard and BlackRock.

In recent commentary, Mathieson has stated his belief that Endeavour’s retail arm is the problem, described the company’s brand positioning in a letter to Hearl last week as “strategically lost”, citing the folly of ‘bespoke’ stores in locations such as Martin Place.

Mathieson has called for Bill Wavish, former Woolworths executive and chairman for Myer, to be appointed as part of an overhaul of the company’s governance.

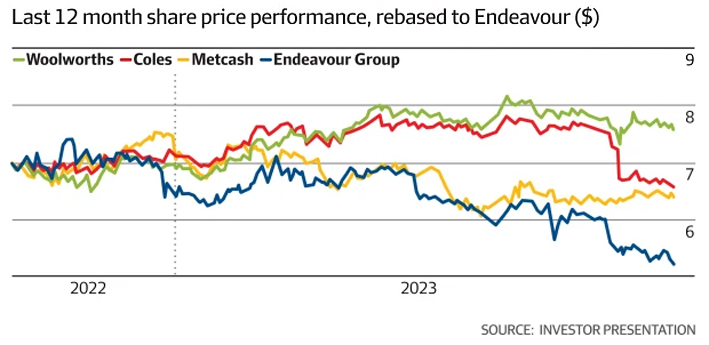

A presentation by Wavish and his team circulated to select investors was obtained by the AFR, and outlines talking points on the ‘destruction’ of “25 per cent of shareholder value in 12 months”, in reference to the $5.6 billion in total value lost since August 2022.

Endeavour was spun off out of Woolworths and floated on the ASX in 2021, closing its first day on the trade floor at $6.02.

It closed today at $5.20 – down 37.5 per cent on its high of $8.32 last August.

Nearly a third of the drop took place in one day, falling from $8.27 to $7.25 on 23 August, as it announced relatively flat earnings and impending headwinds for FY23.

Wavish’s presentation poses that the company’s revenues are “being propped” by its hotels division, as its retail is “going backwards”.

Providing a comparison with its competitors, a series of graphs shows Endeavour’s share price down 25.4 per cent in the prior 12 months.

During this period Coles shares fell six per cent and Metcash fell 8.2 per cent, while Woolworths saw an increase of 8.4 per cent.

Between 2021 and 2023, EDV revenue per store is said to have fallen from $6.2 million to $5.8 million, which its suggested has been made worse by management moving away from large-format “category killers” to boutique stores.

Fighting a PR front in gaming, Endeavour made the decision to implement Victoria’s EGM reforms ten months early, which Mathieson argued would risk costing the company “millions and millions” of dollars.

Mathieson and associates claim the company has been destroying shareholder wealth through its mismanagement of flagship Dan Murphy’s.

Chairman Peter Hearl hit back, saying in a letter to Mathieson that his commentary on Endeavour’s financial performance has a “negative impact on the business, to the detriment of all shareholders”.

Both Mathieson and the board have issued communications to investors and analysts, with the company outlining last week in the notice for its AGM on 31 October, that Wavish would not be able to stand for election if all his regulatory approvals had not been received by that date.

In a statement to the ASX, EDV outlined that due to its relationship with gaming directors must pass a series of probity and regulatory checks from every state in which its pubs operate to be elected to its board, or it risks being non-compliant with gaming and liquor laws.

This process is estimated to take up to six months and is a formal element of Endeavour’s constitution, which dictates that to stand for election a candidate must have all necessary regulatory approvals.

But the board has since buckled to pressure, announcing Wavish’s nomination as a director will go to a shareholder vote at the AGM even if he has not completed regulatory checks, although his appointment would be conditional on the approvals. The company informed the ASX it would engage with regulators in each state to minimise this non-compliance risk.

Wavish thanked the ASX for its involvement and said he was pleased common sense prevailed in what is an important matter.

“With these distractions out of the way, my focus will be on talking to shareholders about the constructive contribution I can make to the Endeavour board, so we can all focus on getting Endeavour back on track.”

Mathieson subsequently called the reversal proof that Hearl was unfit to continue leading Endeavour.