Contrary to mainstream media reports, an increase in EGM numbers and revenue is not due to market demand or opportunism, but an attempt to maintain position as revenue flatlines.

Clubs and pubs are accused of pulling machines out of storage to “meet booming demand” in light of recent data on gaming room numbers and revenues.

In NSW total revenue for H1 of FY24 reached $4.1bn, which is an increase of $217 million, or 5.29 per cent. Individually, clubs are up by 4.7pc and pubs by 6.7pc.

There are also 488 more machines in clubs (up 0.8pc), and 88 more in pubs (0.4pc).

Industry analysts say there are a variety of reasons for the increase in machine numbers. Primarily, machines removed or spaced further apart in clubs during COVID have gradually returned to their former configurations.

“Many clubs scaled down machines but are only now reinstating some of them,” says Geoff Wohlsen of Wohlsen Consulting.

“Some clubs have since also undergone renovations and re-laid their gaming rooms and reinstated machines through that process.”

Despite the apparent ‘increase’ compared with the first half of 2023, the tally now remains considerably lower – by more than 4,500 machines – than at the last increase in active EGMs, in 2017. (NSW clubs then operated 69,861 EGMs.)

Pundits bemoan that the increase comes despite the Minns’ government’s initiatives to reduce the number of machines, last year lowering (by 3K) and capping entitlements at those already in circulation, and increasing the forfeiture rate from one in three to one in two transferred.

But the fact remains that there are more than 5,800 entitlements in the state that are un-activated and not applied to a machine in active use.

Australia’s inflation rate wavered in 2023, reaching 5.4 per cent in Q3 before slipping back to 4.1pc at the end of the year.

Wohlsen observes that the net increase in gaming revenue of 5.29 is lower than portions of 2023 and if population growth is factored in the outcome is “probably a net real decrease”. Yet it could be the motivator to prompt operators to jostle the lineup.

“Venue management may see the growth in nominal terms and simply take it as a positive business indicator and validation to reinstall unused machines,” he suggested.

To the north, gaming in Queensland’s pubs and clubs has achieved a second consecutive month of growth, and substantial 13.3 per cent rise from figures at August 2023, with data from Wohlsen Consulting showing the greatest increase was seen in Brisbane (Inner City SA4).

A continued and notable aspect of the figures is patronage by the 18-25s demographic, which Wohlsen says is “very strong in pubs and casinos” and to a lesser extent in clubs.

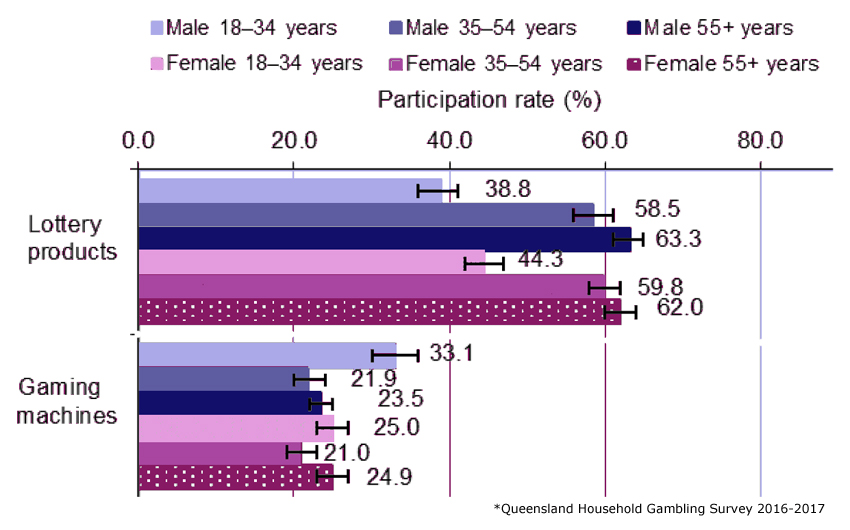

The Queensland Household Gaming Survey has demonstrated for a number of years that the greatest participation levels in gaming machine play – both males and females – is the 18 to 35-year-old segment (see below). Consumer marketing also tends to find this demographic as more likely to seek the ‘latest and greatest’ play options.

EFTPOS and credit card data from CBA on expenditure by this segment is showing they are spending big on discretionary items and entertainment.

Another possibility posed is that many people look to casual gambling during tough economic times in the hope of ‘solving’ their financial problems; studies have shown playing lotto remains particularly prevalent during economic downturns.