A vehicle controlled by investment bank Moelis Australia has finally cemented purchase of the high-flying Redcape Hotel portfolio for $677 million.

Ending around two years’ speculation as to the hotel group’s fate, including rumours of suitors such as a partnership between Charter Hall and ALH, and one between Moelis and hotelier Nelson Meers, Moelis has brought about the acquisition through a specialty fund – the Moelis Australia Redcape Hotel Group (MARHG).

MARHG will comprise close to $400m in equity, coming from a combination of existing Moelis Australia funds, directors and executives, investors, and family offices, as well as around $320m in senior debt, for a total sale price with stamp duty of more than $710m.

The vendors are US hedge funds York Capital and Värde Partners, who came to own Redcape through a collaboration with original purchaser Goldman Sachs, which exited ownership the following year, but was engaged to negotiate the recent sale process.

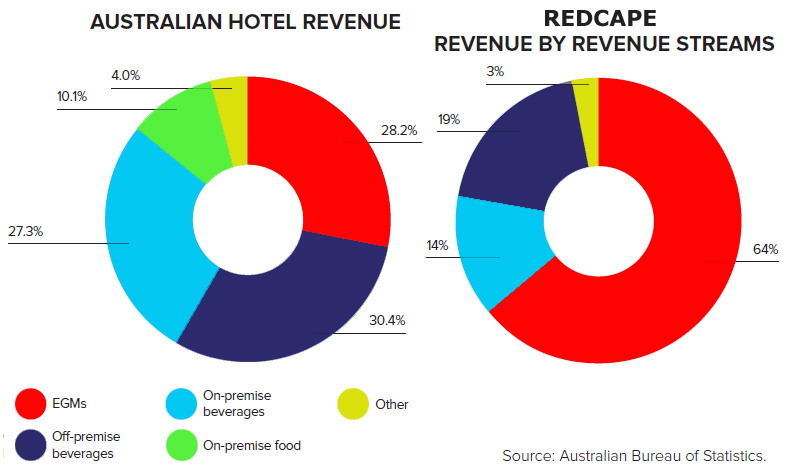

The Redcape portfolio purchased consists of 25 gaming-focused hotels, 23 of which are freeholds. Three are in Queensland, and 22 in NSW, with 18 in the Top 200, 12 of which are Top-100 including #1 and #4.

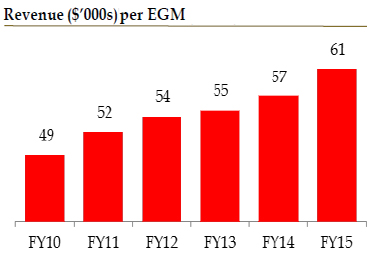

The gaming hotels’ price represents a portfolio capitalisation rate of 9.6 per cent and MARHG is expected to deliver investors an initial cash yield of 8.75 per cent per annum, with anticipated earnings growth of three to five per cent annually.

The deal is expected to be completed during July. Moelis Australia will then invest $40 million in the Fund as a strategic investment, representing a ten per cent interest. Eligible investors will next be given an opportunity to invest.

The majority of Redcape’s head office staff will be retained by Moelis Australia Asset Management, continuing operations in a hotel operating agreement. Key senior executives will be issued up to 426,797 shares in Moelis Australia, as part of the transaction.

Moelis has invested in Sydney gaming hotels since 2014 and reports “outstanding returns” to investors.

“We believe that Redcape represents a leading and unique portfolio managed by a very strong and experienced team at both the executive and operational level,” announced Andrew Pridham, Moelis CEO.

Moelis Australia undertook an IPO in April 2017, but has since entered agreements to acquire both Redcape and Sydney-based specialist property manager Armada Funds Management, bringing another $1.5bn in assets under its wing.

These deals see Moelis now hold more than $2.5bn of assets under management, and increase its forecast Underlying EBITDA for 2017 to $29 million – a 25 per cent increase on its forecast in its recent IPO Prospectus. This even though the Redcape and Armada assets represent only six and seven months (respectively) to the revised forecast for the year.

MARHG sees opportunity in the Redcape portfolio through further investment CAPEX and the possible trading of mature and non-core assets, which it poses are being bought at attractive prices “relative to recent single hotel sales” and represent an opportunity for individual sale “above adopted portfolio pricing”.

The intention is to float MARHG on the ASX in 12 to 18 months.

The deal did not include the recently sold Livingstone Hotel, nor the soon-to-be-settled All Seasons.