The hotel industry is calling on government to review payroll tax, citing the negative affect on job creation in one of the country’s leading sectors for employment.

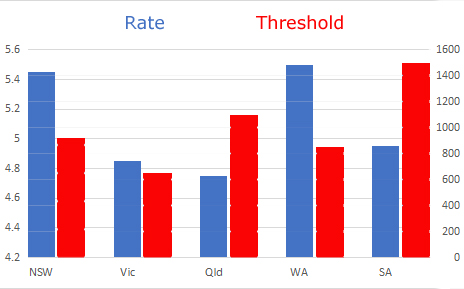

Payroll tax rates around the country are determined by the states.

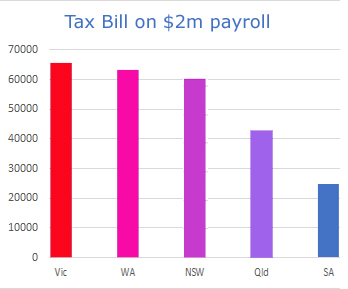

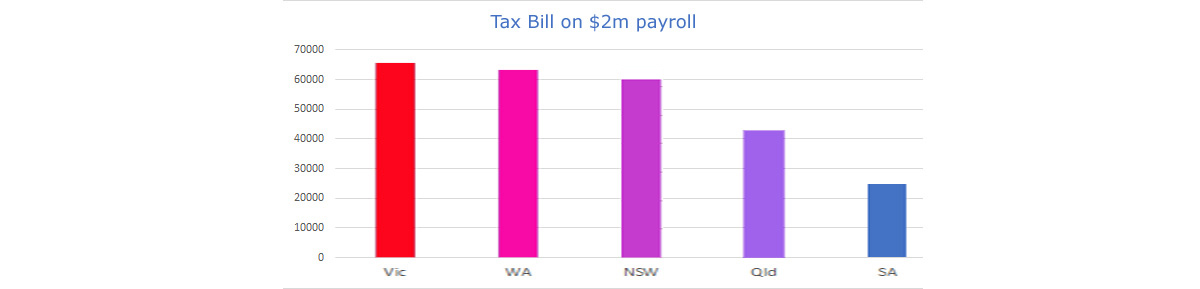

Unsurprisingly, Victoria and New South Wales find themselves at the top of the (lowest) Threshold scale, with Western Australia splitting them for second place.

Bradley Woods, CEO for the Australian Hotels Association (WA) has voiced strong support for reform on the State’s payroll tax, to help support economic growth and job creation in hotel and hospitality businesses.

“We need to take a serious look at any tax that acts as a handbrake on job creation and WA’s payroll tax has long been identified as an area that is ripe for reform,” Mr Woods said.

Payroll taxes have typically been criticised by economists as regressive and inefficient, as they alter the price of labour relative to capital. Moreover, they increase the cost of employing labour, decreasing the demand for it.

If wages are flexible and supply of labour relatively constant, this decreased demand for labour reduces wages and thus the cost of labour, with employees taking the brunt.

The NSW Treasury cites “when wages have sufficient time to adjust, the economic incidence of payroll tax is borne by employees and customers”.

Companies are theoretically able to lessen their tax burden by reducing wages and possibly employment, or through increased prices to customers. The reduction of wage costs makes the Payroll tax comparable to income tax, while increasing prices makes it similar to a consumption tax, such as the GST.

But weighted GST distribution between the states already shows a consumption tax must be mitigated via economic policy. Figures show WA received 4.9 per cent of the GST in FY19 and is set to see 5.4 per cent in FY20.

The sometimes significant fluctuations are attributed to its reliance on contributions by the mining industry.

And yet, the negative effects for employers and their proportionate payroll tax burden, is not flexible, and has not kept in line with economic output.

While the State’s economy is showing signs of recovery and Government is undertaking much-needed budget repair, Woods suggests local businesses could be provided practical and meaningful support through payroll reform.

“With the second-lowest payroll threshold in the country, WA has a system in place that acts as a disincentive for small businesses in particular to hire extra workers and expand their operations.

“It is a fact that payroll tax by its very nature and design is a tax on jobs, so it is important to alleviate that burden as much as possible.

“The AHA believes that the time is right for both sides of politics to give consideration to reforming this tax by lifting the current threshold.”