New data on the latest gaming figures out of Queensland’s OLGR show an industry in upheaval, finding “real growth” in numbers and a dynamic tussle between pubs and clubs for the patron dollar.

Official numbers for Q1 2021 gaming in Queensland were recently released, and Wohlsen Consulting issued its analysis across the hotel and club sectors.

Complications arising from the pandemic last year made comparison difficult or impossible, so the figures were instead compared with the corresponding period of 2019.

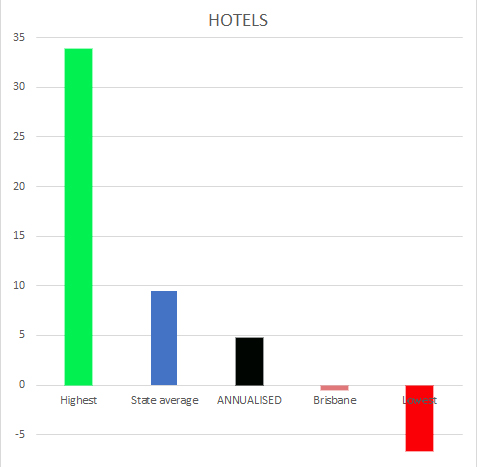

It found an average uplift in machine gross revenue in Queensland (March 2021 vs March 2019) across the two sectors of 9.5 per cent, representing an annual figure of roughly 4.7 per cent. This comes from a 10.7 per cent gain in clubs and 8.3 per cent in hotels.

The most improved region was Burdekin, just south of Townsville, which jumped 33.9 per cent.

Brisbane did not perform well, reporting an overall drop of 0.5 per cent, with the south of the city down 4.2 per cent.

The worst performing region of the state was Banana, inland from Bundaberg, down 6.6 per cent.

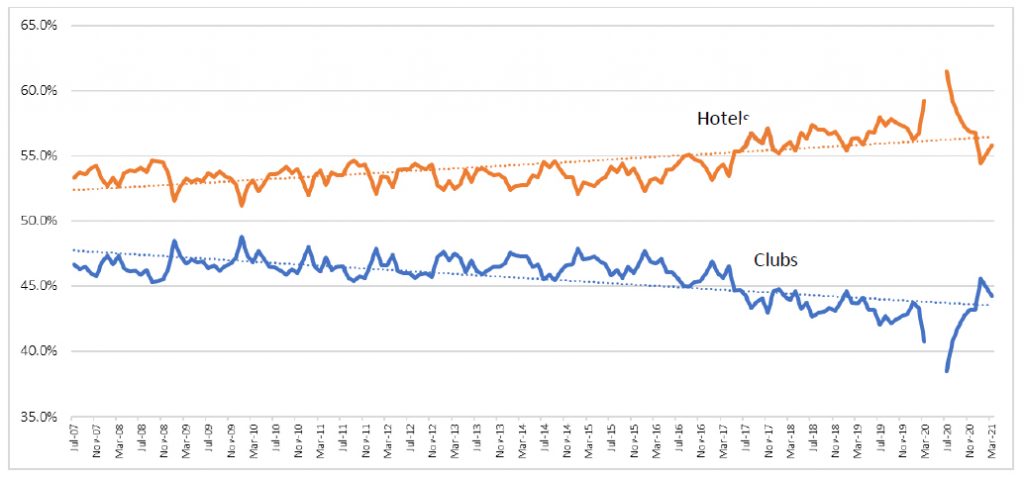

Overall, hotels saw a declining share of the market at 55.8 per cent, sliding 0.5.

Data from when venues reopened after the shutdown, in June, shows a rush of people to the pub, pushing hotel market share in gaming to 62 per cent – only to be followed by a crash that took share back to levels not seen since 2017.

Wohlsen suggests there were potentially several pandemic-related factors at play here. Pubs – with sit-down drinking and many of their usual drawcards on hold – could simply not be what many of their younger patrons wanted them to be.

The larger venues and bigger budgets of many established clubs also meant they could allocate greater resources to the new environment, much to the satisfaction of the aged and health-wary. EGMs were also less likely to be decommissioned due to challenges achieving mandated distancing.

The data shows a total of 25 out of 37 Queensland precincts performed above the average, which corresponds and bodes well with the trend toward regional migration being seen across the country, and certainly in the sunshine state.

It must be noted that Brisbane did suffer its own three-day snap lockdown in March, losing some opportunity and potentially business to neighbouring precincts not under lockdown.

Recent years have seen gaming figures in Queensland struggle to find real growth, defined as surpassing population growth times CPI. This benchmark averaged over the last two years comes in at 3.19 per cent (annualised population increase of 1.5 x annualised CPI increase of 1pc).

In context, the recent stat of 4.7 per cent does mean good news for the sector.

Since March 2017 there has been a noticeable trend toward greater market share by hotels, largely due to success with games that did not work as well in clubs. But the pattern has been disturbed and may not find normalcy anytime soon.

Wohlsen Consulting is Geoff Wohlsen, who studied law and economics before finding the hospitality industry through work at KPMG. Over the years he has assisted many operators, including a lot of work with the former Spirit Hotels and these days the Comiskey Group.

The company provides professional consultation on a range of concerns within venues, particularly clubs, including governance, member research and cultural training.